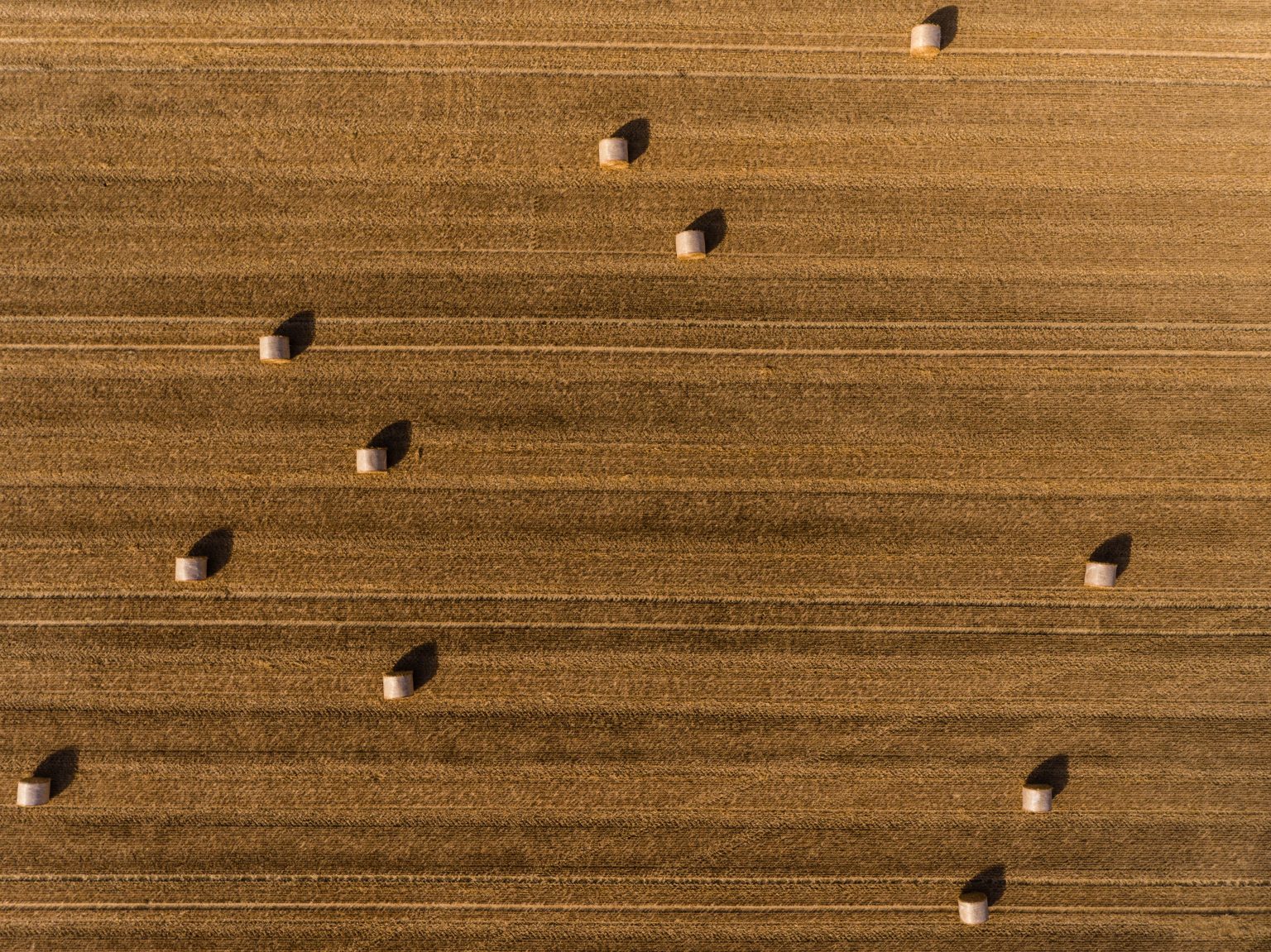

Perhaps you feel more at home surrounded by pastures than pavement. If so, buying a home might be well within reach, thanks to the U.S. Department of Agriculture mortgage program. In fact, the USDA might have one of the government’s least-known mortgage assistance programs.

A USDA home loan is a zero down payment mortgage for eligible rural and suburban homebuyers. USDA loans are issued through the USDA loan program, also known as the USDA Rural Development Guaranteed Housing Loan Program, by the United States Department of Agriculture.

In 2017, as a part of its Rural Development program, the USDA helped approximately 127,000 families buy and upgrade their homes. The program is designed to “improve the economy and quality of life in rural America.” It offers low interest rates and no down payments, and you may be surprised to find just how accessible it is.

Qualifying for a USDA-backed mortgage

Income limits to qualify for a home loan guarantee vary by location and depend on household size. To find the loan guarantee income limit for the county where you live, consult this USDA map and table

USDA guaranteed home loans can fund only owner-occupied primary residences. Other eligibility requirements include:

- U.S. citizenship (or permanent residency)

- A monthly payment — including principal, interest, insurance and taxes — that’s 29% or less of your monthly income. Other monthly debt payments you make cannot exceed 41% of your income. However, the USDA will consider higher debt ratios if you have a credit score above 680.

- Dependable income, typically for a minimum of 24 months

- An acceptable credit history, with no accounts converted to collections within the last 12 months, among other criteria. If you can prove that your credit was affected by circumstances that were temporary or outside of your control, including a medical emergency, you may still qualify.

Applicants with credit scores of 640 or higher receive streamlined processing. Those with scores below that must meet more stringent underwriting standards. And those without a credit score, or a limited credit history, can qualify with “nontraditional” credit references, such as rental and utility payment histories.

How USDA home loans work

Going one step further in helping prospective homebuyers, the USDA issues mortgages to applicants deemed to have the greatest need. That means an individual or family that:

- Is without “decent, safe and sanitary housing”

- Is unable to secure a home loan from traditional sources

- Has an adjusted income at or below the low-income limit for the area where they live

The USDA usually issues direct loans for homes of 2,000 square feet or less, with a market value below the area loan limit. Again, that’s a moving target depending on where you live. Home loans can be as high as $500,000 or more in pricey real estate markets like California and Hawaii, and as low as just over $100,000 in parts of rural America.

Eligible home locations

Metropolitan areas are generally excluded from USDA programs, but pockets of opportunity can exist in suburbs. Rural locations are always eligible.

Next steps

To apply for a USDA-backed loan, talk to a participating lender. If you’re interested in a USDA direct mortgage or home improvement loan or grant, contact your state’s USDA office.

A program sponsored by the USDA might seem to be targeted to farmers and ranchers, but your occupation has nothing to do with the qualification process. Eligibility is simply a matter of income and location. And no, you don’t need to know sorghum from a soybean.

Get My Free Rate Quote